Iowa Governor Approves Residential Tax Credits For New Geothermal Heat Pumps and Retrofits

June 15, 2012

June 15, 2012  Kyriaki (Sandy) Venetis

Kyriaki (Sandy) Venetis Iowa Governor Terry Brand has enacting a series of tax incentives for new residential geothermal heat pump installations and retrofits.

Stock photo.

Stock photo.

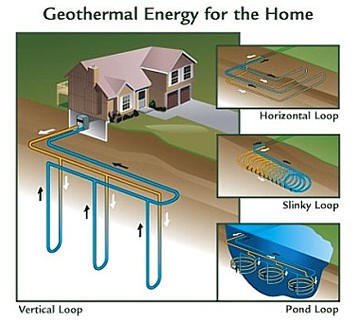

For people that aren’t familiar with them, geothermal heat pumps are similar to ordinary heat pumps, but instead of using outside air, they use the earth’s natural underground systems to provide heating, air conditioning, and in most cases, hot water.

Actually, the California Energy Commission’s Consumer Energy Center gives one of the best explanations about how these systems work, before talking more about the Iowa tax credits.

The California energy center explains that wherever you live, a few feet below the earth’s surface, the ground remains at a relatively constant temperature regardless of the outside air temperature.

The center says, “Although the temperatures vary according to latitude, at six feet underground, temperatures range from 45 degrees to 75 degrees Fahrenheit. That’s the principle behind geothermal heat pumps. In the winter, they move the heat from the earth into your house. In the summer, they pull the heat from your home and discharge it into the ground.”

The California center also says, “Studies show that approximately 70 percent of the energy used in a geothermal heat pump system is renewable energy from the ground. The earth’s constant temperature is what makes geothermal heat pumps one of the most efficient, comfortable, and quiet heating and cooling technologies available today. While they may be more costly to install initially than regular heat pumps, they can produce markedly lower energy bills - 30 percent to 40 percent lower.”

Through incentives enacted last month in Iowa, geothermal heat pumps installed on residential properties are now eligible for a state tax credit that is equal to six percent of the cost of a system, which is equal to 20 percent of the federal residential geothermal tax credit.

The new state tax credit law says that applicable cost will include the “mechanical, electrical, plumbing, ductwork, or other equipment, labor and expenses included in or required for the construction or installation of the geothermal system.”

The new state tax credit law will apply retroactively to systems installed beginning Jan. 1, 2012, “so the Iowa credit will be available for the 2012-2016 tax years,” said that Iowa Department of Revenue.

“Any credit in excess of the tax liability is not refundable, but the excess can be carried forward to the tax liability for the next ten years or until depleted, whichever is earlier,” added the Iowa Department of Revenue.

Initial claims for these Iowa state tax credits need to be filed no later than Feb. 1 2013, including all costs and other information associated with the construction and installation of the systems.

The geothermal system must also meet the federal Energy Star criteria, which provides a federal tax credit of 30 percent. The federal credit is claimed on the federal IRS form 5695, Residential Energy Credits, which you submit with your taxes.

On your 1040 form, you enter this tax credit information from your 5695. Also, save your receipts and manufacturer’s certification statement for your records.

Additional Resources

Reader comments and input are always welcomed

Reader Comments